Financial services institutions face a stark choice: embrace AI for customer service or watch competitors pull ahead. And the stakes are high: customers who get quick, effective support stay longer and spend more.

Despite all the "AI support is terrible" headlines, customers actually love getting instant answers to simple questions. No phone calls, no hunting through policy documents. The real magic happens when they can seamlessly reach a helpful, happy human to resolve complex issues.

That's exactly what leading banks like Bank of America and fintechs like Klarna are doing. They’re winning with AI.

The winning strategy is two-pronged:

-

A narrowly scoped, AI-powered chatbot that handles the most common inquiries with high accuracy and low risk.

-

An internal AI assistant that empowers human representatives with fast access to full customer context, product data, and policy knowledge.

This approach sidesteps the all-or-nothing gamble. You get great service with great guardrails, resolving your valid concerns around risk, compliance, and trust.

The challenge: Why AI chat in banking has stalled

Many financial institutions remain stuck on the sidelines, despite leaders running external AI chatbots for over five years. The hesitation makes sense. Generative AI introduces risks:

-

Regulatory exposure from hallucinated or non-compliant responses

-

Data privacy concerns when internal data meets external models

-

Customer frustration from chatbot loops and poor escalation

-

Reputational damage, customer attrition, even legal consequences

But sitting on the sidelines has costs, too. AI-powered customer service can cut resolution time by 50% or more, reduces live agent headcount for the same service quality, and boosts upsell revenue. Most customers prefer speedy AI help on simple questions, especially if they know they can easily reach a context-aware human when things get complicated.

A safer, smarter approach: Two-pronged AI customer service deployment

Rather than betting everything on an autonomous chatbot, leading firms see results with a two-pronged approach that reduces risk while improving service, operational efficiency, and lifting revenue.

The high-confidence FAQ bot

-

Resolves known, repetitive issues ("What's my routing number?" or "When's my bill due?")

-

Works from a narrow set of FAQs and structured documents

-

No freeform search or model improvisation

-

Escalates to human agents when uncertainty, complexity, or frustration is detected

The AI-enhanced agent assistant

-

Operates behind the scenes, never directly facing customers

-

Pulls from broad internal knowledge base, customer 360, and real-time transaction data

-

Uses generative AI to summarize interactions, suggest answers, and guide next actions

-

Keeps compliance, empathy, and context front and center through human oversight

Together, these two elements deliver 24/7 responsiveness without compromising trust. The tooling, infrastructure, and data patterns to implement this approach are proven and available.

Business impact: Metrics that matter

This two-pronged strategy drives real results for both efficiency and revenue:

Reduce Mean Time to Resolution (MTTR) - Instant answers for common issues slash resolution time

-

Klarna - 2 minutes vs. 11 minutes previously

-

Bank of America - 98% of clients get answers within 44 seconds

-

SouthState - Information retrieval dropped from 7 minutes to 32 seconds

Reduce Cost/Interaction - Chatbot containment reduces live agent load

-

Moving 50% of common queries to AI chatbots saves 30-40%+

Increase Customer Satisfaction (CSAT) - Customers prefer faster, more relevant support

-

Ally Bank - Better CSAT as AI-assisted human agents “focus energy on meaningful customer interactions.”

Increase Revenue Both chatbots and AI-assisted human agents better recognize upsell opportunities

Decrease Compliance risk Explainable, auditable AI decisions

Real-world success: Wells Fargo, RBC, and Klarna

Leading institutions are already validating this approach.

-

Wells Fargo's “Fargo” assistant uses GenAI with an orchestration layer that ensures PII never touches the model. It handled 245M+ customer queries in 2024 without data leakage.

-

Bank of America’s “Erica” contains chatbot interactions to high-confidence inquiries, deflecting millions of calls per month and handing off smoothly when needed.

-

Royal Bank of Canada’s NOMI augments the human experience with personalized insights and Q&A, helping reduce attrition to under 1% among active users.

-

Klarna famously flipped to AI chatbot-only customer service before adding humans back for “VIP” customer service, proving the two-pronged approach covers all the bases. Still, the AI chatbot handled two-thirds of customer service conversations in its first month, equivalent to the work of 700 full-time human agents.

Each of these institutions relied on controlled rollouts, real-time data access, and strong governance, which is precisely what the AI-ready operational data layer enables.

Start with an AI-ready operational data layer

“Generative AI will only become truly useful if we can trust it, and the only way that can happen is to ensure we apply basic principles of responsibility to it and the data that is used to create it.”

– Andrew Reiskind, Chief Data Officer, Mastercard

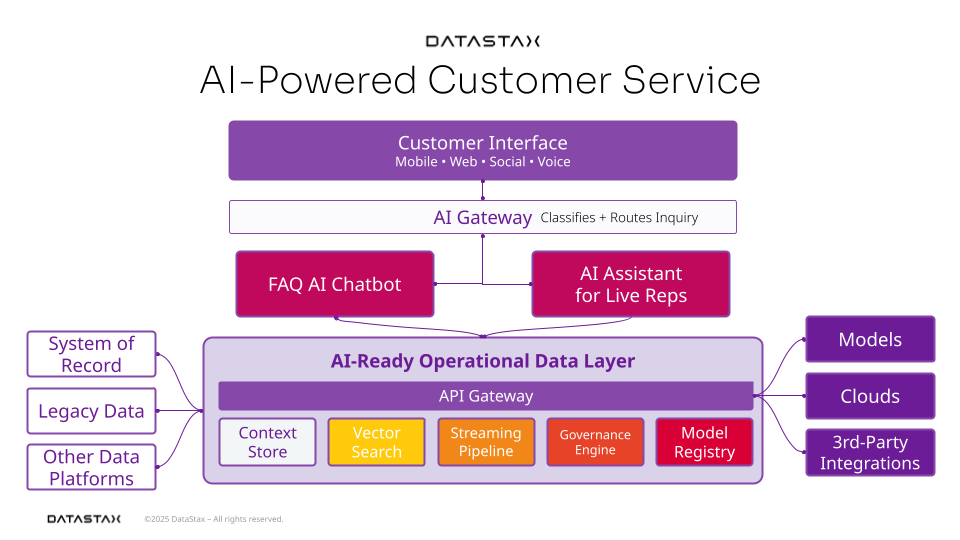

GenAI in finance is only as reliable as the data it draws on. Without real-time access to clean, governed, relevant data, AI can't deliver safe or satisfying service. That’s why it’s smart to start with AI-ready operational data layer, which includes:

-

Context store for customer sessions, account state, and prior interactions

-

Vector search for semantic similarity matching and document retrieval

-

Streaming pipeline to feed AI agents the latest transaction and interaction data

-

Governance engine to ensure auditability, traceability, and compliance

-

Model registry to manage model lifecycle, versioning, and deployment

Connect it to your reality:

-

Audit your current support inquiries: what’s repetitive vs. nuanced?

-

Scope a first-gen FAQ chatbot with clear boundaries and escalation paths

-

Empower support agents with an AI co-pilot trained on product, policy, and customer data

-

Connect both experiences to a trusted AI-ready operational data layer

(Read more about building an AI-ready operational data layer in our recent blog post, Beyond Modernization: AI-Powered Finance Requires an AI-Ready Operational Data Layer.)

A suggested architecture

Once you have an AI-ready ODL in place, delivering successful, safe AI-powered customer service is relatively easy. With logic and semantic detection embedded in the AI gateway, customer inquiries are routed to either the AI chatbot or the AI-assisted live representative.

Skip the false choice

Financial services institutions don't need to choose between innovation and safety. A two-pronged AI chat strategy anchored in an AI-ready ODL delivers transformative service experiences while preserving trust and compliance.

The path is proven. Leading banks are already there. Ready to start building your next generation customer experience?

We’re here to help

Want help getting started on AI-powered customer service? Connect with DataStax AI and data experts to discuss your specific infrastructure needs and get a customized roadmap for enabling AI at scale in your financial institution.

Or, get started today with DataStax AI Platform-as-a-Service.

FAQs

How does mainframe migration benefit financial services organizations?

Mainframe migration benefits financial services organizations by enabling them to modernize legacy infrastructure with cloud databases that support AI-driven capabilities at scale. As demonstrated by the MobilePay case study, migrating from mainframe systems to a distributed cloud database allowed the payments application to handle massive user growth (reaching 82% of Denmark's population) while delivering new functionality rapidly—something that would have been "extremely difficult to meet in a timely manner, if at all" on legacy mainframes. The migration to a cloud-native NoSQL platform enables financial institutions to leverage AI for real-time fraud detection, personalized banking recommendations, and financial intelligence at scale, while simultaneously reducing total cost of ownership by up to 60% and eliminating the operational constraints and expensive licensing fees associated with traditional mainframe RDBMS systems.

How does AI improve fraud detection in the financial industry?

AI significantly improves fraud detection in the financial industry by leveraging cloud-native databases like Apache Cassandra® to enable real-time processing and analysis of massive transaction volumes. The scalable, distributed architecture of cloud databases allows financial institutions to ingest and analyze data from multiple channels—ATMs, mobile payments, and e-commerce—simultaneously, detecting fraudulent patterns as they occur rather than after the fact. AI algorithms powered by these cloud databases can process millions of transactions per second with ultra-low latency, enabling immediate fraud decisions (accept, challenge, or deny) while dramatically reducing false positives through machine learning models that continuously adapt to emerging threat patterns. The combination of AI and cloud databases like Astra DB provides the high availability, linear scalability, and real-time analytics capabilities essential for maintaining 100% uptime during peak transaction periods while ensuring secure, compliant fraud detection that protects both financial institutions and their customers.